As we accelerate into a digital world, the understanding of customers’ banking patterns online and segmenting them based on their preferences to predict and serve them banking services has become a top priority for banks worldwide.

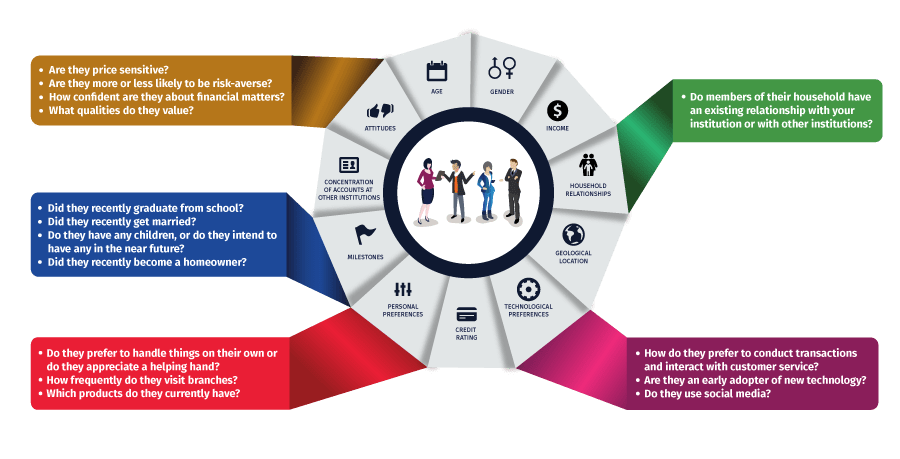

Most banks have a large customer base - with different characteristics in terms of age, income, values, lifestyle, and more. Customer segmentation is the process of dividing a customer dataset into specific groups based on shared traits.

According to a report from Ernst & Young, “A more granular understanding of consumers is no longer a nice-to-have item, but a strategic and competitive imperative for banking providers. Customer understanding should be a living, breathing part of everyday business, with insights underpinning the full range of banking operations.

Customers are diverse in nature and require personalized services from banks, on the other hand, banks need to shift from a traditional mindset and accept the new kinds of customer preferences. No customer is obviously the same. A few attributes about one customer can match with another customer thereby helping banks better serve the segment of customers by predicting their wants and needs well in advance. Banks need to tap into the potential of understanding customers’ data by segmentation using artificial intelligence and machine learning techniques. Segmenting customers’ data helps banks personalize customer experiences while enhancing and defining products making them quickly adapt to customer needs, habits and interests.

This dataset consists of 1 Million+ transaction by over 800K customers for a bank in India. The data contains information such as - customer age (DOB), location, gender, account balance at the time of the transaction, transaction details, transaction amount, etc.